I need to see the full speech he made. I read a summarised transcript and he made some very good points. Putin (and larger, Russia) are not the enemy of the West in my opinion.Well this is interesting. Of all people...

Putin Warns Wokeness Is Destroying The West: It Happened In Russia, It’s Evil, It Destroys Values

Russian President Vladimir Putin slammed during a speech on Thursday the far-left woke ideology that he said is causing societal ills throughout the Western world, saying that it is no different than what happened in Russia during the 1917 revolution. Putin made the remarks during a plenary...www.dailywire.com

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Politics

- Thread starter Longwalker

- Start date

- Joined

- Sep 12, 2010

- Messages

- 16,207

- Reaction score

- 53,299

- Location

- Zambia

- Website

- www.takerireservezambia.com

- Deals & offers

- 27

- Media

- 360

- Articles

- 24

- Member of

- sci int,wpaz, PGOAZ

- Hunted

- zambia, tanzania, zimbabwe,Mozambique ,hungary, france, england

Well this is interesting. Of all people...

Putin Warns Wokeness Is Destroying The West: It Happened In Russia, It’s Evil, It Destroys Values

Russian President Vladimir Putin slammed during a speech on Thursday the far-left woke ideology that he said is causing societal ills throughout the Western world, saying that it is no different than what happened in Russia during the 1917 revolution. Putin made the remarks during a plenary...www.dailywire.com

I will raise a

to him....

to him....Randy F

AH legend

I think those lights that you do see are only 40 watt.LIghts are on but nobody's home.

Vashper

AH elite

- Joined

- Jan 20, 2019

- Messages

- 1,142

- Reaction score

- 4,146

- Media

- 32

- Member of

- All-army military hunting society, Russian Union of hunters and fishermen.

- Hunted

- Only Russia

He said a lot of things there. For example: .I need to see the full speech he made. I read a summarised transcript and he made some very good points. Putin (and larger, Russia) are not the enemy of the West in my opinion.

Everyone says that the existing model of capitalism – and today it is the basis of the social structure in the vast majority of countries - has exhausted itself, there is no way out of the tangle of increasingly complicated contradictions within its framework.

The devils took him there to historical exercises, for some reason he remembered Marx and Engels (in the presence of Chinese comrades, by the way). My wife suggested that these are the consequences of covid

.

. But as for modernity, he says the right things that the majority wants to hear.

sgt_zim

AH legend

- Joined

- Mar 26, 2017

- Messages

- 4,728

- Reaction score

- 18,449

- Location

- Richmond, Texas

- Media

- 33

- Articles

- 1

- Member of

- NRA, Houston Safari Club Foundation, NWTF

- Hunted

- South Africa, Idaho, Texas, Louisiana

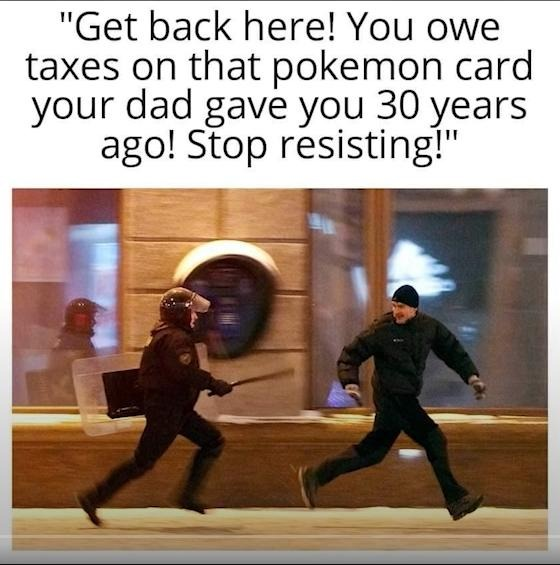

In light of the democrats ongoing attempts to modify the tax code to allow the federal government to begin collecting taxes on unrealized capital gains.

Ray B

AH legend

Taxing unrealized capital gains- So if I buy a house for $100K 30 years ago and it is now appraised at $300K, the gain was $200K so they tax me on that. so then there is a housing crash and the value drops back to $200K- are they going to reimburse me for the unrealized capital loss?

WAB

AH ambassador

Taxing unrealized capital gains- So if I buy a house for $100K 30 years ago and it is now appraised at $300K, the gain was $200K so they tax me on that. so then there is a housing crash and the value drops back to $200K- are they going to reimburse me for the unrealized capital loss?

That’s how it works now on realized gains and losses. Perhaps they’re too stupid to realize that tax revenue will be up and down like a whore’s drawers with this insanity. Not to mention the almost infinite ways to game this kind of lunacy. I wonder if a lobotomy is required to join these folks?

sgt_zim

AH legend

- Joined

- Mar 26, 2017

- Messages

- 4,728

- Reaction score

- 18,449

- Location

- Richmond, Texas

- Media

- 33

- Articles

- 1

- Member of

- NRA, Houston Safari Club Foundation, NWTF

- Hunted

- South Africa, Idaho, Texas, Louisiana

not bloody likely. you are on the hook for all liabilities, they get to reap the rewards of the assets.Taxing unrealized capital gains- So if I buy a house for $100K 30 years ago and it is now appraised at $300K, the gain was $200K so they tax me on that. so then there is a housing crash and the value drops back to $200K- are they going to reimburse me for the unrealized capital loss?

It's a "heads I win, tails you lose" scenario. Just perfect.

Brent in Az

AH ambassador

These people are Koo-Koo for Cocoa puffs.

sgt_zim

AH legend

- Joined

- Mar 26, 2017

- Messages

- 4,728

- Reaction score

- 18,449

- Location

- Richmond, Texas

- Media

- 33

- Articles

- 1

- Member of

- NRA, Houston Safari Club Foundation, NWTF

- Hunted

- South Africa, Idaho, Texas, Louisiana

It pains me to know that such morons exist in this world, and that they wield any influence at all.These people are Koo-Koo for Cocoa puffs.View attachment 433569

Tbitty

AH fanatic

These idiots don't realize bulls are the extreme minority of cattle headed to "slaughter." If anything, the bull pen would be the safest option (unless we also are worried about castration).These people are Koo-Koo for Cocoa puffs.View attachment 433569

Hunter4752001

AH elite

PETA types would probably welcome making it compulsory, and not just for cattle.(unless we also are worried about castration).

Ray B

AH legend

Between the USMC and grad from college I worked a few years and summers in slaughterhouses. We'd kill 95% beef, the remainder lambs & pork. Of the beef 90% were steers. 9+% old milk cows ( I hated those big old Holsteins) and less than 1% bulls. The bulls didn't act like they were terrified- they acted like they were just REALLY MAD!!! they'd kick at anything in range and their heads were tough enough that the knocker wouldn't put them down so we had to shoot them with a 410 which can be a trick since the bull isn't standing still. I'm sure no one from PETA has ever dealt with a real live bull or they would have no sympathy for the ultimate outcome.

sgt_zim

AH legend

- Joined

- Mar 26, 2017

- Messages

- 4,728

- Reaction score

- 18,449

- Location

- Richmond, Texas

- Media

- 33

- Articles

- 1

- Member of

- NRA, Houston Safari Club Foundation, NWTF

- Hunted

- South Africa, Idaho, Texas, Louisiana

and if they're mature adult bulls, castration won't do much anyway. gotta snip 'em when they're still small calves so that it'll grow into a nice, fat steer.These idiots don't realize bulls are the extreme minority of cattle headed to "slaughter." If anything, the bull pen would be the safest option (unless we also are worried about castration).

Areaonereal

AH fanatic

Taxing capital gains has never accounted for property acquired many years ago at a certain price and the inflation factor. In essence you loose the buying powera in today’s dollar after paying capital gains in most cases. that is, u buy a Remington 700 in 1973 for $129.00 and sell it for $500.00 today. In essence your LT Capital gains on $371.00. That $129.00 dollars had greater buying power then than it does now in today’s economy. No factor for inflation has ever been accounted for in the tax code for capital gain that I am aware of. So taxing unrealized gains is a total and complete theft of and redistribution of wealth thru confiscation, regardless of your being a billionaire or middle class taxpayer.

Last edited:

lwaters

AH legend

- Joined

- May 20, 2011

- Messages

- 2,441

- Reaction score

- 3,587

- Location

- Manhattan Kansas

- Media

- 117

- Articles

- 1

- Member of

- SCI

- Hunted

- Texas,Namibia,Kansas, Missouri, Wyoming, Colorado, Idaho, South Africa, New Zealand

I doubt if your in that income level. I think there was 700 people who would have to pay. I've sold a mutual fund for a loss invested in a similar fund . The market went up but got to take the capital loss on the first fund.Taxing unrealized capital gains- So if I buy a house for $100K 30 years ago and it is now appraised at $300K, the gain was $200K so they tax me on that. so then there is a housing crash and the value drops back to $200K- are they going to reimburse me for the unrealized capital loss?

Tundra Tiger

AH legend

Happy Halloween everyone. This year I'm going as a mostly peaceful protester.

Aaron N

AH legend

- Joined

- Nov 18, 2014

- Messages

- 2,079

- Reaction score

- 3,421

- Location

- Alberta, Canada

- Media

- 7

- Articles

- 2

- Hunted

- Canada, South Africa

And the teacher of the year award goes to……..Happy Halloween everyone. This year I'm going as a mostly peaceful protester.

View attachment 433776

The kids must have a blast with you!

jpr9954

AH legend

- Joined

- Feb 16, 2021

- Messages

- 2,723

- Reaction score

- 24,800

- Location

- North Carolina

- Website

- onlygunsandmoney.com

- Articles

- 4

- Member of

- NRA, SAF, SCI, DSC

- Hunted

- South Africa

I suggest they make a call to the Brain Barn.These people are Koo-Koo for Cocoa puffs.View attachment 433569

Members online

- bohannon

- sammo

- buck wild

- DGGardner

- 375er

- Chryss

- chashardy

- neckdeep

- ThreeJacks

- enchunt

- SRvet

- Tex .416

- Velo Dog

- CM McKenzie

- degoins

- Jjs92186

- leslie hetrick

- USN

- Pblaine

- lil 2 sleepy

- Skshyk

- Wahoo

- jasyblood

- Sogwe safaris

- Kurt Swanson

- abnhog

- BrownMax

- Addicted911

- Clark8907

- FaeChewnin

- Rob Sparks

- skydiver386

- TSALA HUNTING SAFARIS

- jshem

- jpg

- Hunt anything

- 280AI

- JeffD

- kukusya

- ryanjones

- towserthemouser

- Wade J VanGinkel

- Corey0372

- Tgood1

- SABENA1

- John Wasmuth

- NTO

- DG870

- dchamp

- ABIGFOOTZ

Total: 69,477 (members: 1,210, guests: 68,267)

Forum statistics

Latest posts

-

-

-

-

Who wants to attend a Professional Hunter course?

- Latest: PAUL_MAUSER

-

Latest profile posts

This is the African safari deal you’ve been waiting for!

Trophy Kudu Bull + Trophy Gemsbuck - ONLY $1,800 for BOTH!

Available for the 2025 & 2026 seasons

Elite Hunting Outfitters – Authentic, world-class safaris

Limited spots available – Act now!

Make your African hunting dream a reality! Contact us today before this deal is gone!

Trophy Kudu Bull + Trophy Gemsbuck - ONLY $1,800 for BOTH!

Available for the 2025 & 2026 seasons

Elite Hunting Outfitters – Authentic, world-class safaris

Limited spots available – Act now!

Make your African hunting dream a reality! Contact us today before this deal is gone!

Updated Available dates for this season,

9-25 June

25-31 July

September and October is wide open,

Remember I will be in the USA for the next 16 days , will post my USA phone number when I can get one in Atlanta this afternoon!

9-25 June

25-31 July

September and October is wide open,

Remember I will be in the USA for the next 16 days , will post my USA phone number when I can get one in Atlanta this afternoon!

I am on my way to the USA! will be in Atlanta tonight! loving the Wifi On the Delta flights!